Key Takeaways

- Strategy CEO Phong Le last week stunned investors when he said the company would sell bitcoin under certain conditions.

- The enterprise software company has not sold a single bitcoin since it established a coin treasury in August 2020

- Strategy stock has lost about 60% of its value since hitting a record high in July.

Math is greater than faith, apparently.

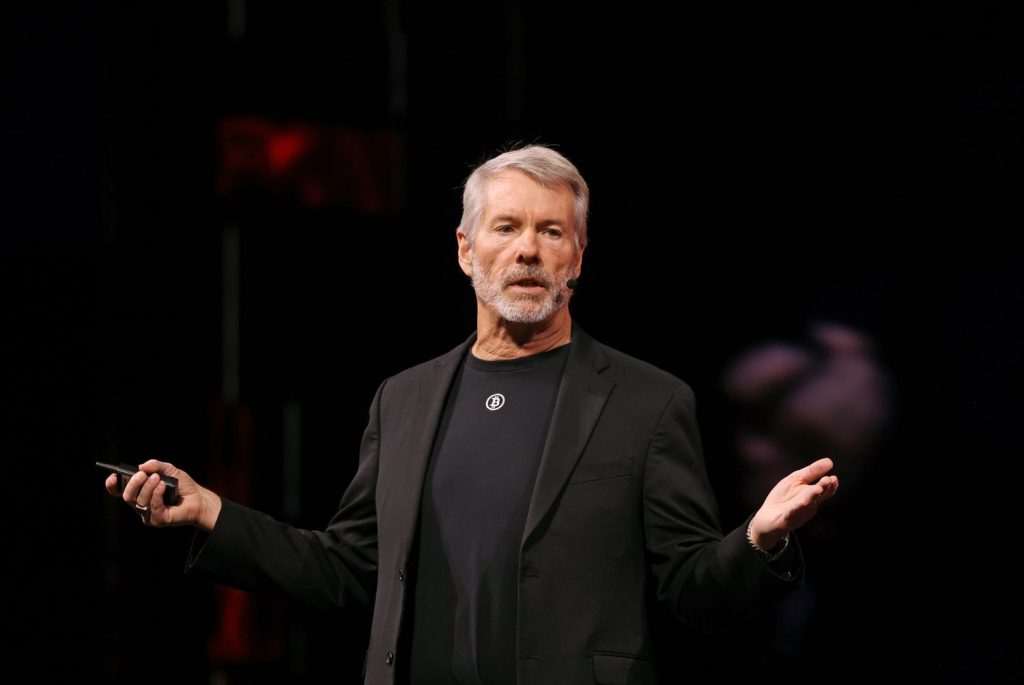

Strategy (MSTR), the enterprise software company made famous for stockpiling bitcoin, stunned its investors with the possibility that it could sell. Though Strategy executive chairman and bitcoin evangelist Michael Saylor has long advocated for holding bitcoin indefinitely and recently said that he “won’t back down”, the company’s CEO Phong Le said last week that the company would, under certain conditions, sell.

The company’s about-face lands amid what would appear to be the onset of crypto winter, and after more than five years of holding onto every single bitcoin it bought since establishing a bitcoin treasury. Between bitcoin’s roughly 30% tumble from recent peaks and Strategy’s own stock performance, a near-term sale is in the realm of possibility and could drag coin prices even lower.

At least one of the two conditions Le outlined—if the company’s stock market capitalization falls below the net asset value of its bitcoin holdings—is close to being met. Strategy’s stock has fallen 60% since hitting a record high in July, bringing its market cap very close to the value of its bitcoin in spite of the lift shares are getting today along with a bitcoin bounce.

Why This Matters To You

Michael Saylor, Strategy’s co-founder and executive chairman, is a bitcoin whale, a closely watched market influencer. If Strategy does sell its bitcoin, it could spook crypto markets and send bitcoin prices lower.

“My hope is our mNAV doesn’t go below one, but if we did and we didn’t have access to other capital, we would sell bitcoin,” he said in an interview last week. “There’s the mathematical side of me that says that would be the absolutely right thing to do.”

Strategy’s “mNAV,” a valuation metric that compares the market value of its shares to the value of its bitcoin holdings on a fully diluted basis is 1.01, according to blockchain analytics firm Artemis.

Saylor on Monday justified the possibility of selling bitcoin. “We will make rational decisions that are in the best interest of the equity shareholders,” he said in an investor presentation. “Now there are some people that will say, ‘Well, if you sell bitcoin that means you’re not committed to bitcoin.’ Well, that’s not really true.”

While the news of Strategy’s possible plans for selling inspired some told-you-so posts on social media, others appear to be rallying behind the company as crypto prices rallied in recent sessions. Bitcoin was back above $91,000 Tuesday afternoon, after falling as low as $84,500 over the weekend. Strategy shares gained about 6% on Tuesday.

Meanwhile, the company on Monday announced that it bought 130 more bitcoin, boosting its stockpile to 650,000, valued at roughly $59 billion based on recent prices. It also set aside $1.44 billion to pay the dividends on its preferred stock and interest on its outstanding debt, and updated its 2025 earnings guidance assuming a lower year-end price for bitcoin of $85,000 to $110,000. The company previously set guidance around bitcoin being around $150,000 at the end of the year.