Stock in Michael Saylor’s Bitcoin treasury company Strategy was up 1.22% in early trading today, giving the company a brief period of relief. The stock has declined 66% since its high last July, and this morning its “mNAV”—a technical gauge of whether the company is worth more or less than the Bitcoin it holds—was at 1.02.

If that gauge falls below 1, then technically the company is worth less than the Bitcoin it owns. At that point, the stock would be sold off by many investors because there is no point in owning a stock whose value is based on Bitcoin if the stock is worth less than the Bitcoin.

The stock has been sitting above this danger zone since November.

Already, the market cap of the company is worth less than its Bitcoin. Its market cap was $47 billion today; the Bitcoin held by the company is worth just under $60 billion. That on its own is a perilous position. But if the company’s mNAV (“market-to-net asset value”) falls below 1 then the stock potentially enters a new world of pain. mNAV is a measure of the company’s total market cap plus its debt, minus its cash, divided by its total Bitcoin reserve. If that value is worth less than 1 then the case for owning Strategy stock becomes harder to argue.

Fortune contacted the company for comment.

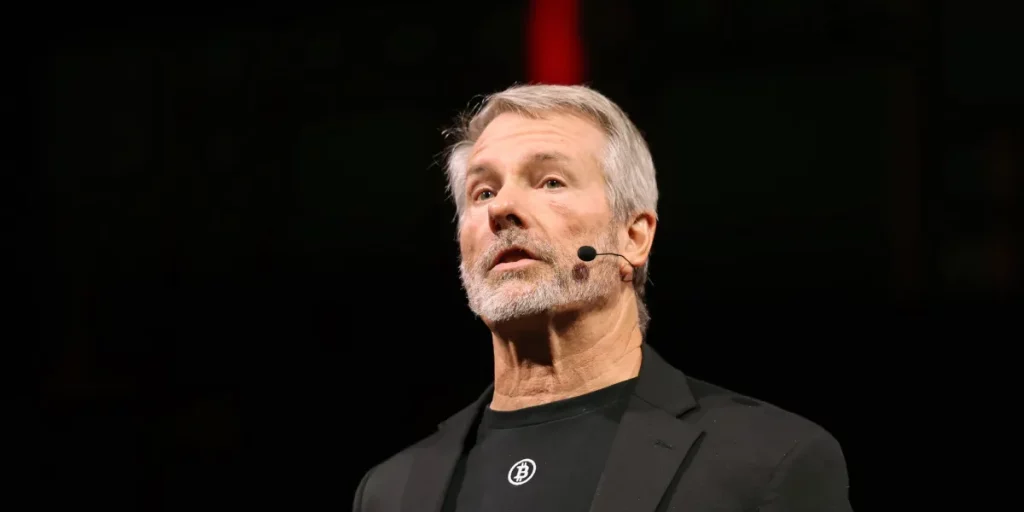

Saylor, as usual, has been tweeting bullishly about MSTR shares, including this chart showing that “open interest” (investor positions that have not been closed out) are the equivalent of 87% of the company’s market value. The implication is that the stock is highly traded (although many of those positions are undoubtedly short bets against the company). He also posted an AI-generated picture of him taming a polar bear.

Below the level of mNAV at 1 lies another dangerous threshold for Strategy: the average price at which Strategy has historically accumulated Bitcoin. Over the years, that price was about $74,000 per coin. Currently, Bitcoin trades at $89.6K. If the price were to fall below $74K it would imply that Strategy’s Bitcoin stash was worth less than what Saylor has paid for it.

Strategy fans would argue that might be a time to buy—if the stock was worth less than its Bitcoin then the price per share might rise to meet the price of Bitcoin; it might rise even more if Bitcoin resumed its march higher.

But that, again, would be a sore test for traders who are not true believers. Why hold a stock that is worth less than the underlying asset it represents?

Join us at the Fortune Workplace Innovation Summit May 19–20, 2026, in Atlanta. The next era of workplace innovation is here—and the old playbook is being rewritten. At this exclusive, high-energy event, the world’s most innovative leaders will convene to explore how AI, humanity, and strategy converge to redefine, again, the future of work. Register now.