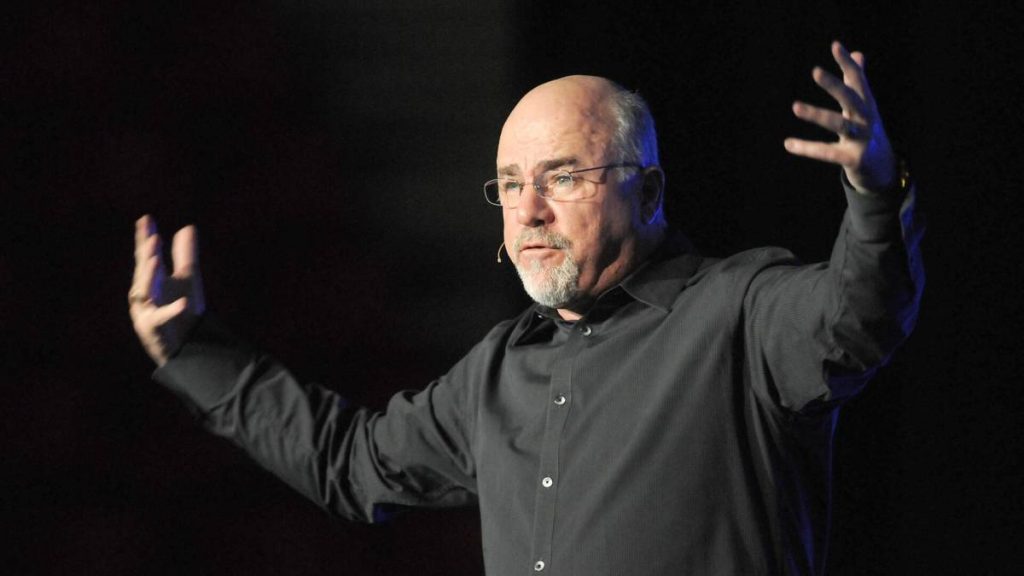

Radio show host and bestselling personal finance author Dave Ramsey has a big caution for American workers, and in my 30 years of experience I can say I agree with him.

If your employer offers a 401(k) plan, especially one with matching funds, take them up on it the second you get the chance.

“If you’re leaning on your 401(k) to be a big part of your plan for retirement, it’s important to get your questions answered. Your golden years literally depend on investment choices you make today,” Ramsey wrote. “Learning how your 401(k) works is the first step toward making confident decisions about your retirement.”

A 401(k) is a feature of a qualified profit-sharing plan that allows employees to contribute a portion of their wages to individual accounts, according to the Internal Revenue Service (IRS).

Related: Dave Ramsey raises red flag on Social Security

Elective salary deferrals made by an employee are generally not included in that employee’s taxable income, unless the contributions are designated as Roth deferrals, the IRS explains.

The IRS also clarifies that employers are permitted to make contributions to their employees’ retirement accounts, adding to the overall savings accumulated over time.

The IRS further notes that when funds are eventually distributed — along with any earnings generated in the account — those amounts are typically included in taxable income at retirement.

The exception applies to qualified distributions from designated Roth accounts, which the IRS states are not subject to income tax when the applicable requirements are met.

Dave Ramsey explains how a 401(k) works

When you enroll in a 401(k), you choose the amount you want to contribute and select your investments from the options your plan administrator makes available.

Your contributions are then taken straight out of your paycheck and directed into the investments you’ve selected.

If you’re already participating in your employer’s plan, reviewing your pay stubs will show exactly how much you’re putting in — and how much your employer is adding if they provide a matching contribution, according to Ramsey.

More on personal finance:

- Dave Ramsey warns Americans on critical Medicare mistake to avoid

- Finance author sends strong message on housing costs

- Scott Galloway explains his views on retirement, Social Security

Research from The National Study of Millionaires found that the vast majority of millionaires — eight in ten — regularly contributed to their workplace 401(k). That consistent habit played a major role in helping them accumulate seven‑figure wealth over time.

“When it comes to saving for retirement, your 401(k) offers that special ingredient in the form of tax advantages that help your investment dollars go further,” Ramsey wrote.

“You see, your 401(k) is like a warm, fuzzy sweater that shelters your investments from the harsh, bitter elements — which, in this case, are taxes. But how it protects your investments from taxes depends on whether you have a traditional 401(k) or a Roth 401(k).”

Dave Ramsey discusses traditional 401(k)s and Roth 401(k)s

Ramsey explains important facts about traditional 401(k)s and Roth 401(k)s:

Traditional 401(k): Pre‑tax contributions and tax‑deferred growth

- Contributions to a traditional 401(k) reduce your taxable income in the year you make them, since the money goes in before taxes are applied.

- Because your taxable income is lowered, you may owe less when you file your tax return.

- Taxes are postponed until retirement, when you’ll owe income tax on your contributions, your employer’s contributions, and any investment gains.

- You receive the tax benefit upfront, but the tax bill eventually comes due when you withdraw the funds.

Roth 401(k): After‑tax contributions and tax‑free growth

- Roth 401(k) contributions are made with money that has already been taxed, so you don’t get an immediate tax break.

- The trade-off is that qualified withdrawals in retirement — including investment earnings — are completely tax‑free.

- This approach favors long‑term planning: you pay taxes now to avoid them later when you’re living off your savings.

- Employer contributions to a Roth 401(k) are still treated as pre‑tax and will be taxed when withdrawn.

Dave Ramsey says a 401(k) is a great place to begin retirement savings

Ramsey is clear: A 401(k) is a smart way to approach saving for retirement.

“If your employer matches your contributions (and most do), you get an instant 100% return on part of the money you invest in your 401(k),” Ramsey wrote. “That’s free money. Take it!”

“But hold up: 401(k)s do have some shortcomings,” he added. “First, you’ve got a limited number of mutual funds to choose from, which can keep you from investing in high-performing funds.”

Related: Dave Ramsey, AARP sound alarm on Medicare