Investing in quantum computing doesn’t have to feel like playing the lottery. There are proven winners with exposure to quantum computing worth buying and holding right now.

It’s still early, but quantum computing appears to be another significant leap forward in technological innovation. Quantum computers utilize the laws of physics to perform complex calculations exponentially faster than even today’s supercomputers can.

Researchers at McKinsey & Company anticipate that quantum computing can grow to a $100 billion market over the next decade, and who knows where it will go from there.

Investors have poured into several pure-play quantum computing stocks, but companies like IonQ and D-Wave Quantum currently generate little revenue and have already risen to sky-high valuations. However, investing in quantum computing doesn’t need to be an all-or-nothing gamble.

Here are three companies with established and successful businesses that also deal in quantum computing. Consider buying them as top quantum computing stocks for 2026.

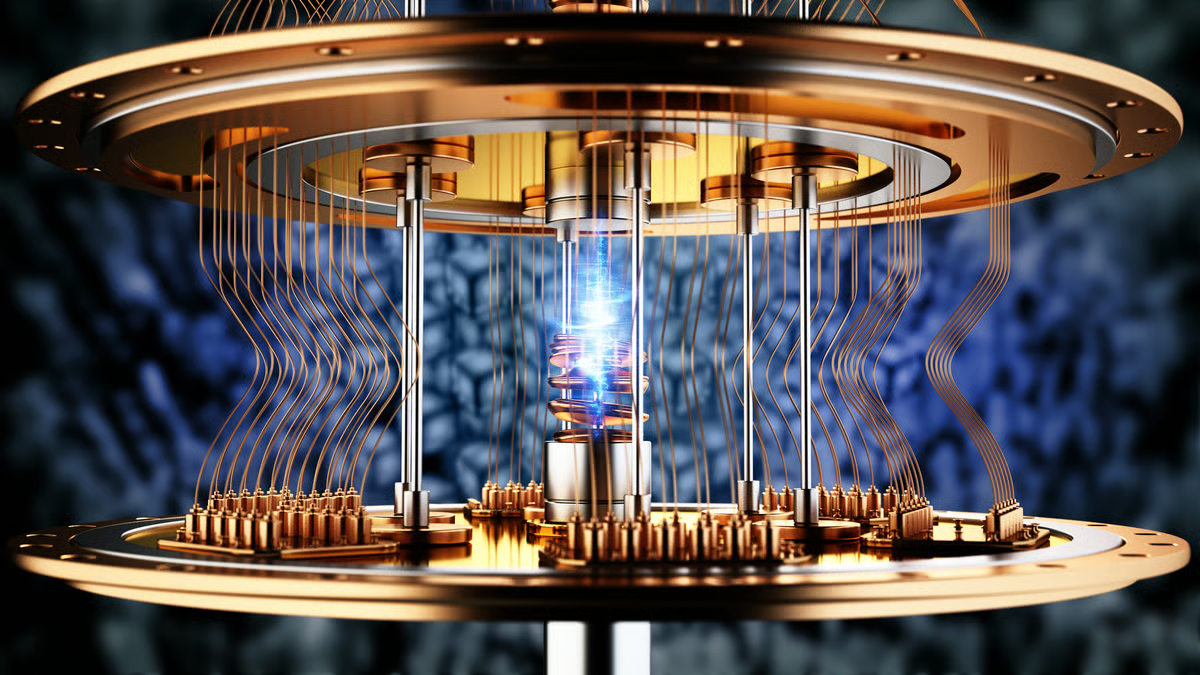

Image source: Nvidia

1. Nvidia

The explosive growth in artificial intelligence (AI) has rocketed Nvidia (NVDA 0.35%) to the top of the technology world as the leader in GPU chips used in data centers for AI workloads. Quantum computing could become a key stepping stone to more advanced AI over the coming years as computing power demands continue to increase.

Nvidia wouldn’t want to be on the outside of quantum computing if it began displacing traditional GPUs, so the company has a clear interest in exploring quantum technology. It has developed NVQLink, which enables quantum processors to work with AI supercomputers, as well as CUDA-Q, an open-source development platform for quantum systems and applications.

Today’s Change

(-0.35%) $-0.66

Current Price

$187.47

Key Data Points

Market Cap

$4.5T

Day’s Range

$186.83 – $192.17

52wk Range

$86.62 – $212.19

Volume

4.2M

Avg Vol

186M

Gross Margin

70.05%

Dividend Yield

0.02%

In other words, Nvidia wants to control the intersection between today’s GPU-powered applications and tomorrow’s quantum-powered opportunities. Nvidia’s dominance in the GPU space gives it a strong positioning to achieve that. The company’s core data center business remains strong, with a $500 billion order backlog that is likely to lead to another banner growth year in 2026.

2. International Business Machines (IBM)

Some view International Business Machines (IBM +2.54%) as a tech dinosaur. The company has been around for decades and has struggled at times to adapt to industrywide changes. To its credit, IBM has steadily divested old assets and made strategic acquisitions to remake itself as a leading provider of hybrid cloud computing, AI software, and consulting services to enterprise customers.

Simply put, corporations turn to IBM for help in integrating new technology into their businesses, and IBM provides them with advice and any necessary products and services. IBM is also a leading pioneer in quantum computing. It has developed quantum processors and full computers, as well as Qiskit, which it claims is the most widely used software development kit for quantum computing.

International Business Machines

Today’s Change

(2.54%) $7.50

Current Price

$302.47

Key Data Points

Market Cap

$283B

Day’s Range

$294.42 – $303.04

52wk Range

$214.50 – $324.90

Volume

4.1M

Avg Vol

4.8M

Gross Margin

57.22%

Dividend Yield

2.22%

IBM has deeply entrenched relationships across the corporate world, which helps get it to the table and win business. To date, IBM has generated over $1 billion in lifetime revenue related to quantum computing. IBM probably won’t generate explosive growth. Still, it’s a steady and reliable stock for those seeking exposure to quantum computing with lower risk.

3. Microsoft

It shouldn’t come as a surprise to see Microsoft (MSFT +1.20%) on this list. The $3.5 trillion tech behemoth has its nose in just about every tech trend out there. Microsoft has a strong foothold with corporate customers through its Microsoft 365 and Dynamics 365 software, as well as its Azure cloud services platform. It’s also a clear pathway to introduce new products and services, which could eventually include quantum computing.

Currently, Microsoft’s quantum efforts reside at the research level. Early last year, it announced it had developed a quantum chip, the Majorana 1, capable of fitting 1 million qubits on a single chip — far more than current quantum computers have. Remarkably, Microsoft achieved a new state of matter to build this chip. Its topological core is neither a solid, a liquid, nor a gas, but a new state of matter.

Today’s Change

(1.20%) $5.66

Current Price

$478.51

Key Data Points

Market Cap

$3.6T

Day’s Range

$469.75 – $478.74

52wk Range

$344.79 – $555.45

Volume

23M

Avg Vol

23M

Gross Margin

68.76%

Dividend Yield

0.71%

It highlights the high ceiling that a company with Microsoft’s deep pockets and brilliant talent possesses. If quantum computing takes off, Microsoft will undoubtedly be a competitor. For now, investors can continue to enjoy the strong growth across Microsoft’s various businesses. As arguably the world’s leading technology company, Microsoft is a no-brainer to include in this list.