I am always looking for interesting and informative charts, especially ones I can include in my quarterly call that explain something clients are curious about or introduce a lower-profile idea. The call that kicked off 2026 dived into the weakness in the dollar. Given how significant the US Dollar weakness has been, let’s take a look at what has been happening with the world’s reserve currency and why it is significant to stocks, bonds, and commodities.

2025 was the year international stocks finally caught up to the US. Since the financial crisis, the US has led the world’s economy and equity markets. That changed significantly last year, as the S&P 500 and even the Nasdaq 100 lagged behind while international stocks gained over 33%. That was about twice the increase we saw in the U.S

And there’s a simple reason for this: The weakest U.S. dollar since 2017.

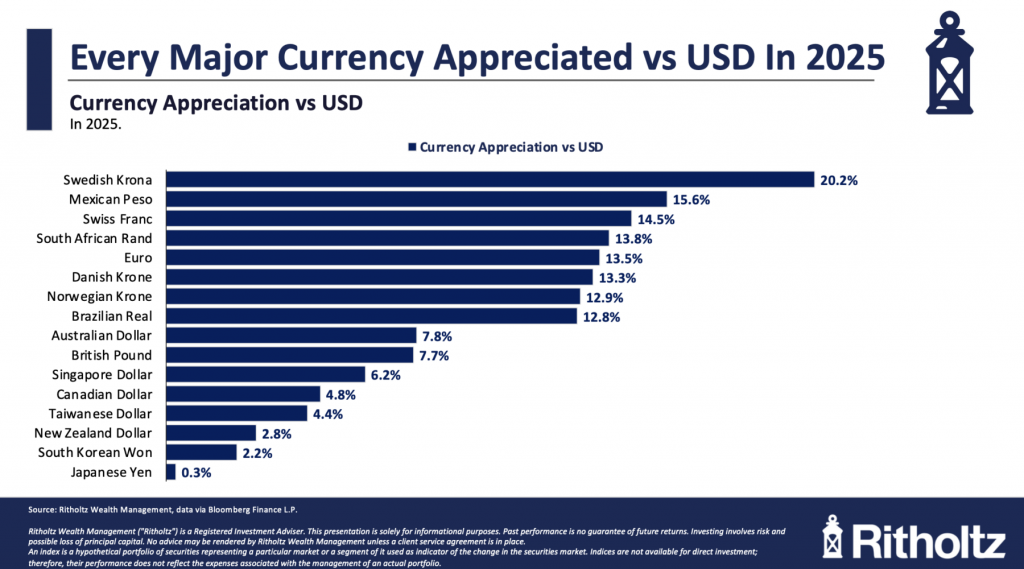

As the chart at the top of the page shows, every major currency has outperformed the United States currency in 2025 – even Japan.

That is not a coincidence. This isn’t partisan; it isn’t politics; it is simply a fact: the dollar was down 9.2%. The last time it was down this much was in 2017, when it fell 9.9%. Both years marked the first term of a Trump presidency; both involved tariffs; both alienated trade partners.

Here’s a straightforward explanation: U.S. trading partners are very unhappy with tariffs and defense policies. We are part of a deeply interconnected global economy, and although none of our trading partners has our level of wealth, they are not without options. They don’t support the end of the post-war alliances nor “America First” – and are responding accordingly.1

Thus, the trend we observed throughout 2025 was simply a Repatriation Trade. Overseas Investors, including private holdings, sovereign wealth funds, public funds, and other large pools of capital, decided to reduce some US-specific risk. They sold portions of their US holdings in dollars, converted that into their local currencies—euros, pounds, yen, Swiss francs, pesos, yuan—brought the cash back home, and then purchased local stocks and bonds.

I cannot imagine any other reason for every single major currency to appreciate so much against the US Dollar without some variation of the above occurring. Traditionally, rates and the dollar move more or less together; when we see this kind of decoupling, it usually means something unusual is going on:

This is what happens when your trading partners and our security partners are unhappy with your policies and vote with their dollars. (If anybody has a better explanation as to what’s going on, I’d love to hear it).

I am not a catastrophist; I don’t think this is the end of the dollar as the global reserve currency or the end of Pax Americana; it is, however, concerning and warrants attention. If you treat your trading partners poorly, they aren’t just gonna take it; they are going to respond in kind. They bought a chunk of their capital home. As it turns out, repatriating all those dollars made those markets do much better than US markets. Not that plus ~18% is terrible, it’s just relatively, we were the laggard.

What will cause this change? I don’t see this administration reversing course unless the Supreme Court forces them to do so. I am genuinely surprised they have failed to do so in what is an obvious case.

But that’s how I see the dollar story.

Previously:

IEEPA Tariffs Update (January 27, 2026)

Stocks, Bubbles & Market Myths (January 16, 2026)

Tariffs Likely To Be Overturned (November 5, 2025)

The Probability Machine (August 28, 2025)

Might Tariffs Get “Overturned”? (July 31, 2025)

MiB: Special Edition: Neal Katyal on Challenging Trump’s Global Tariffs (September 3, 2025)

See also:

A mysterious delay in the Supreme Court tariffs case

Jason Willick

Washington Post, February 1 2026

__________

1. Position Disclosures: In my personal account, my “2026 SCOTUS reverses IEEPA tariffs” trade is to be long GM, Ford, Caterpillar, and Walmart; the short Silver is a reflection that perhaps the dollar trade has gone as far as it might go for this leg…

See this chart from Jim Reid of Deutsche Bank, who noted: “It was a historic and extraordinary month for precious metals, even with the late pullback. In fact, gold (+13.3%) saw its best monthly performance since September 1999, and silver (+18.9%) posted a 9th consecutive monthly gain.”