In the spirit of the Friedman Unit1 as a metric for Iraq war progress (or in his case, what wound up being the lack thereof), the time has come to inaugurate the Pentagon Unit as a measure of Federal spending to put various programs and proposals on the same footing. That is not how things are operating now, despite the use of Congressional Budget Office scoring methods, which makes any finance-trained person tear their hair.2 To illustrate: the press has duly reported that Defense Department annual spending has reached $1 trillion a year.

Yet in the extended and continuing legislative fight over whether or not to extend Obamacare enhanced subsidies, and what to do if not, the media accounts rarely if ever mention the total expected cost of various proposals, including the base case of extending the current enhanced subsidies. And at least the ones I have seen typically follow the convention of relying on CBO scoring….which is simply to total the gross projected cost over ten years. The CBO has estimated that at $350 billion.

Now back to the Pentagon. Have you seen any mainstream outlet or pundit putting Pentagon spending on the same footing, as in pointing out that in the CBO scoring framework, it’s now a $10 trillion item? Yours truly has not.

This may seem like it is caviling but it isn’t. This sort of attaching higher numbers to a social spending item than the war machine makes the social spending seem more costly than it is via the cognitive bias called anchoring. The first number mentioned relative to a topic, such as salary, frames how subsequent decisions are made. The classic example of anchoring (and this test has been widely repeated) is for an instructor to spin a wheel of fortune, and then after it has landed on a number, to ask students what the number of countries in the world is, and gratuitously work the roulette wheel result into his discussion of their answer. Even with the figure being obviously artificial and irrelevant, the mention of the gambling wheel result has a significant impact on the estimates.

That is before getting to the other big issue, that simple numbers are often very poor ways to look at complex phenomena. Look at the abuse of stock market levels as a proxy for the state of the economy. With budget discussions, the spillover effects very rarely enter into the discussion. Readers can no doubt list the negative externalities that higher military spending produces. And as we will soon discuss, the Congressional row over what to do about replacing Obamacare enhanced subsidies focuses on budget costs and next the impact on household insurance premiums, and the odds that many will go uninsured. This comparatively tight framing of the problem allows a lot of the coverage to skip over that even with the extra subsidies, the US still disgracefully has about 25 million without health insurance, and many of our poor health outcomes, such as the high level of deaths while giving birth and our stalled-out-to-falling life expectancy, are the direct result of significant part of the population getting little or no health care.

So what is the proposed Pentagon Unit? What the US spends on the military, broadly defined, in a day. Keep in mind that that $1 trillion figure is already an understatement, since it does not include Department of Homeland Security spending that really should be treated as military.

But the elephant in the room is that a very large amount of arms services spending is never properly tallied for and might as well be viewed as being on a blank check basis. The Pentagon could not account for $21 trillion (no typo) of spending as of 2018, and the situation has not been remedied, it’s clear that the inability to even dimly ‘splain their spending, the money black hole is a feature, not a bug. Consider this section from an expose in The Nation:

In fiscal year 2015, for example, Congress appropriated $122 billion for the US Army. Yet DoD financial records for the Army’s 2015 budget included a whopping $6.5 trillion (yes, trillion) in plugs. Most of these plugs “lack[ed] supporting documentation,” in the bland phrasing of the department’s internal watchdog, the Office of Inspector General. In other words, there were no ledger entries or receipts to back up how that $6.5 trillion supposedly was spent. Indeed, more than 16,000 records that might reveal either the source or the destination of some of that $6.5 trillion had been “removed,” the inspector general’s office reported.

The point is that even though not all of that $21 trillion can be presumed to have not been properly authorized, it’s a safe guess that a lot was indeed not.

A contact who is an expert on budgetary matters contends that $5 billion a day is a good guesstimate of total Pentagon spending per day. So a Pentagon Unit is $5 billion.

Imagine what the debate over extending the Obamacare enhanced subsidies would look like if the CBO has said that 10 more years would be 70 Pentagon Units. The significance looks quite different.

For the sake of completeness, let’s contrast that with some of the catastrophic effects of letting these extra goodies lapse and not having any replacement. The short version is between the loss of the extra support and expected large increases, average premiums would more than double. From KFF:

For example, with the enhanced tax credits in place, an individual making $28,000 will pay no more than around 1% ($325) of their annual income towards a benchmark plan. If the enhanced tax credits expire, this same individual would pay nearly 6% of their income ($1,562 annually) towards a benchmark plan in 2026. In other words, if the enhanced tax credits expire, this individual would experience an increase of $1,238 in their annual premium payments net of the tax credit….

Based on the earlier federal data and more recent other publicly available information, KFF now estimates that, if Congress extends enhanced premium tax credits, subsidized enrollees would save $1,016 in premium payments over the year in 2026 on average. In other words, expiration of the enhanced premium tax credits is estimated to more than double what subsidized enrollees currently pay annually for premiums—a 114% increase from an average of $888 in 2025 to $1,904 in 2026. (The average premium payment net of tax credits among subsidized enrollees held steady at $888 annually in 2024 and 2025 due to the enhanced premium tax credits).

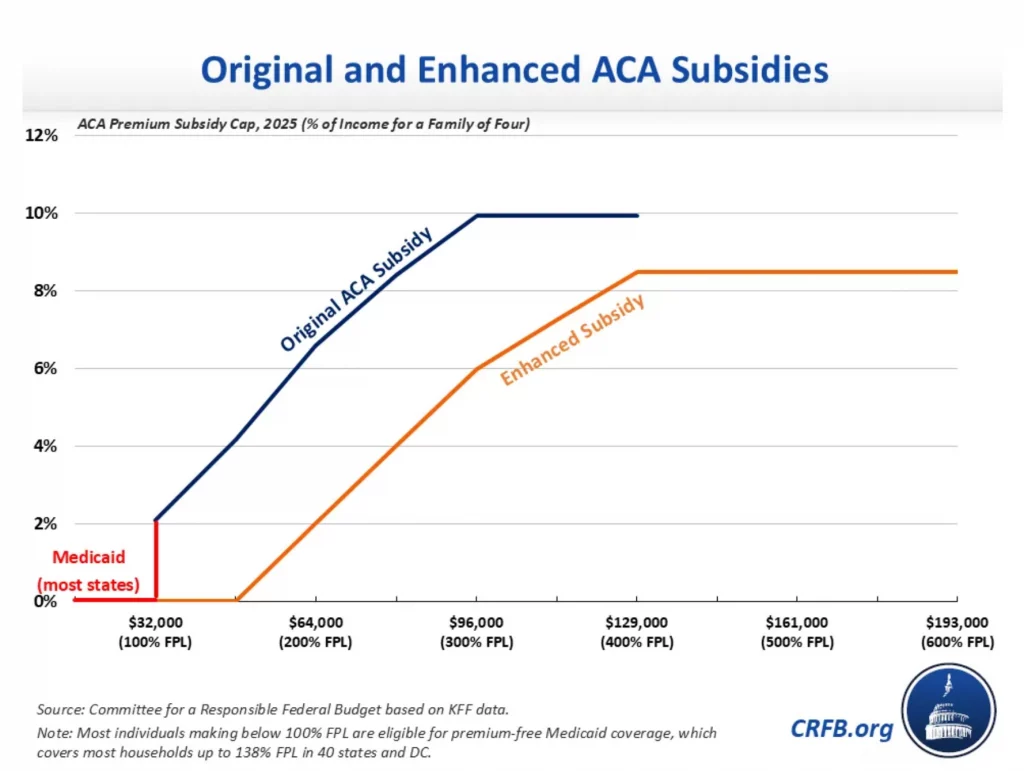

A Committee for a Responsible Federal Budget post in November gave some useful overview information:

ACA subsidies are primarily paid directly to insurers throughout the year and then reconciled through tax returns, taking the form of income tax credits for individuals.

The gross federal cost of these subsidies and related spending grew from $18 billion in 2014 – the first year in which individuals were eligible for the subsidies – to $50 billion in 2018, $53 billion in 2020, $92 billion in 2023, and an estimated $138 billion in 2025. The net federal cost of these subsidies is somewhat lower due to less federal spending and tax breaks related to employer-sponsored health insurance and uncompensated care.

The article also described how the CBO anticipated that the end of the enhanced subsidies would produce death spiral dynamics, with those getting policies being sicker on average, producing higher premium costs:

The expected increase in pre-subsidy premiums is partially driven by rising overall health care costs. On top of general inflation and even faster rising health care prices, experts have pointed to rising labor costs, increased provider consolidation, growing demand from an aging population, expanding use of new GLP-1 and other specialty drugs, and the effect of tariffs on certain drugs and medical supplies and equipment as possible drivers.

The premium increase is also driven in part by expected changes to the overall risk pool covered by the exchanges. Assuming the enhanced premium subsidies expire as scheduled, CBO projects the number of people enrolled in the exchanges will decline by more than 2 million in 2026. Those who drop coverage, on average, are likely to have lower health care costs, while those who remain do so in part because of their higher health care needs. As a result, pre-subsidy premiums will rise. Based on CBO estimates, the expiration of the enhanced subsidies is likely to push up pre-subsidy premiums by about 5%.2 Other policy changes will have a mixed impact on premiums.

KFF confirmed the CBO’s assumptions. From the Guardian yesterday:

In a recent survey, KFF found that if the subsidies expire, a third of the 24 million US adults who buy coverage through the ACA marketplace said they were likely going to select a lower-premium plan – with higher deductibles and out-of-pocket costs – while a quarter of enrollees said they would be “very likely” to go uninsured.

When you increase premiums dramatically, “the healthy people drop out and therefore the pool is sicker”, said Gerard Anderson, a professor of health policy and management at Johns Hopkins University…“The sicker people are the only ones that stay in the program until it becomes no longer sustainable and the insurance company stops even offering the plan,” Anderson said.

Those people with high deductibles or no insurance could also struggle to pay medical bills if they become sick or injured.

Hospitals would then have to treat more people who do not have means to pay for their care, [Emma] Wager [senior policy analyst for KFF’s program on the Affordable Care Act] said.

That would be particularly hard on small and rural hospitals “that have very thin margins”, Wager said.

“If they can’t make it work financially with the increase in uncompensated care that they are providing, they may have to close. In all likelihood, they will certainly think about raising their prices and charging everybody more,” Wager said. “That includes people with employer-sponsored insurance.”

Should the subsidies expire, when people in rural areas decide they still want health insurance, they will also see an even greater premium increase than those in urban areas, according to the Century Foundation, a progressive think tank.

Yet those same people who depend on rural hospitals and the ACA also are more likely to support Republicans, most of whom voted against extending the tax credits. More than half of ACA enrollees live in congressional districts represented by a GOP member, according to KFF.

“Farmers, ranchers … are heavily dependent on the ACA”, Wager said. “There are a lot of people who are represented by Republicans in Congress who have Affordable Care Act coverage who will bear the brunt of these premium hikes.”

Having done a lot of survey work, consumer respondents generally overstate their propensity to make purchases. The motivations include pleasing the party making the survey and wanting to look able to afford expenditures. So I would expect the drop down/out rate to be even higher.

Yours truly should be following the horse-trading on maybe getting Something Done, but it is too painful. The Hill reported, in typical Republican fiddling while Rome burns that Senator Bill Cassidy said maybe a deal can get done by year end. That’s arguably too late.

Oh, yes, the subsidies expire by year end, but patients may feel they need to decide before that what Obamacare plan to take, if any.

The deadline for signing up for coverage to start January is December 15; patients can push that back to January 15 for coverage to start February 1. I am not clear on what happens if they had a plan that started January 1, 2025 and do not opt into a new plan as of January 1, 2026. I assume they stay on their old plan for the month of January, but they would face an increase in that one month premium, both due to being rolled into the 2026 version of their current plan plus potentially losing the enhanced subsidy. I suspect some are not willing to take the risk and will choose (or will have chosen) by today.

CNN late on Sunday confirmed both that even the Congressional drop dead date is sooner (both houses go on recess) and an agreement seems remote:

Lawmakers are scrambling to address skyrocketing health care costs in the final days before Congress leaves Washington for the holidays, with enhanced tax credits that make insurance premiums more affordable for millions of Americans set to expire at the end of the month….

Speaker Mike Johnson has vowed to hold a vote on a Republican-led bill released last week, which includes provisions to lower premiums for certain Affordable Care Act enrollees through a cost-sharing reduction program. The plan would not extend the Covid-era subsidies due to lapse at the end of this month….

House Minority Leader Hakeem Jeffries has thrown cold water on the narrow GOP health care plan and has kept his powder dry on whether more Democrats may back efforts to strong-arm votes on bipartisan bills to extend the Obamacare tax credits into the new year with some changes.

Even if health care legislation were to pass the House, it would face a Senate that failed to garner 60 votes to advance bills, including a three-year ACA subsidy extension last week, and a president who has made clear he favors funneling federal aid directly to patients through health savings accounts, also known as HSAs…

Sen. Jon Ossoff, the most vulnerable Senate Democrat in next year’s midterm elections, warned a failure to address the expiring tax credits would be a “political disaster” for Republicans.

“The politics are clear, but that’s not the most important part of this. We really are talking about life and death,” Ossoff told CNN’s Manu Raju on “Inside Politics Sunday,” adding that half a million people in his home state of Georgia are projected to lose their access to health insurance altogether.

“Maybe that gets lost sometimes in the drama inside the beltway,” he said. “The vote that members cast, whether to extend these tax credits means people will live or people will die.”

The incentives ought to favor Republicans Doing Something, even if in reality not much, to have a talking point so as to try to escape blame for not supporting an extension of the enhanced subsidies. But they seem too committed to having to cut spending here, when the underlying premium increases and voters’ upset about affordability makes that a political death wish. And the Pentagon Unit comparison helps show how penny wise and pound foolish they are being…if they could muster up the nerve to go after the real pork machine. The military makes even our bloated health care complex look like pikers.

_____

1 From Wikipedia:

One Friedman Unit is equal to six months, specifically the “next six months”, a period repeatedly declared by New York Times columnist Thomas Friedman to be the most critical of the then-ongoing Iraq War even though such pronouncements extended back over two and a half years.

2 The proper way to cost a project with long-term expenditures is to use net present value. The CBO does not allow for the fact that future dollars are cheaper than current dollars.