by Calculated Risk on 12/08/2025 02:46:00 PM

From Dodge Data Analytics: Dodge Momentum Index Decreases 1% in November

The Dodge Momentum Index (DMI), issued by Dodge

Construction Network, decreased 1.1% in November to 276.8 (2000=100) from the downwardly

revised October reading of 280.0. Over the month, commercial planning ticked down 0.1% and

institutional planning declined by 3.4%. Year-to-date, the DMI is up 36% from the average

reading over the same period in 2024.

“The influx of high-value data center work, compounded by inflationary cost pressures,

continues to support elevated DMI levels,” stated Sarah Martin, Associate Director of

Forecasting at Dodge Construction Network. “Overall, nonresidential construction is expected to

strengthen in 2027, led primarily by data center and healthcare projects. Other nonresidential

sectors are more likely to face softer demand and heightened macroeconomic risks.”

On the commercial side, activity slowed down for warehouses and hotels, while planning

momentum was sustained for data centers, traditional office buildings and retail stores. On the

institutional side, education, healthcare, public and recreational planning saw weaker

momentum, after strong activity in recent months. Planning for religious buildings, however,

continued to accelerate. Year-over-year, the DMI was up 50% when compared to November

2024. The commercial segment was up 57% (+36% when data centers are removed) and the

institutional segment was up 37% over the same period.

…

The DMI is a monthly measure based on the three-month moving value of nonresidential

building projects going into planning, shown to lead construction spending for nonresidential

buildings by a full year to 18 months.

emphasis added

Click on graph for larger image.

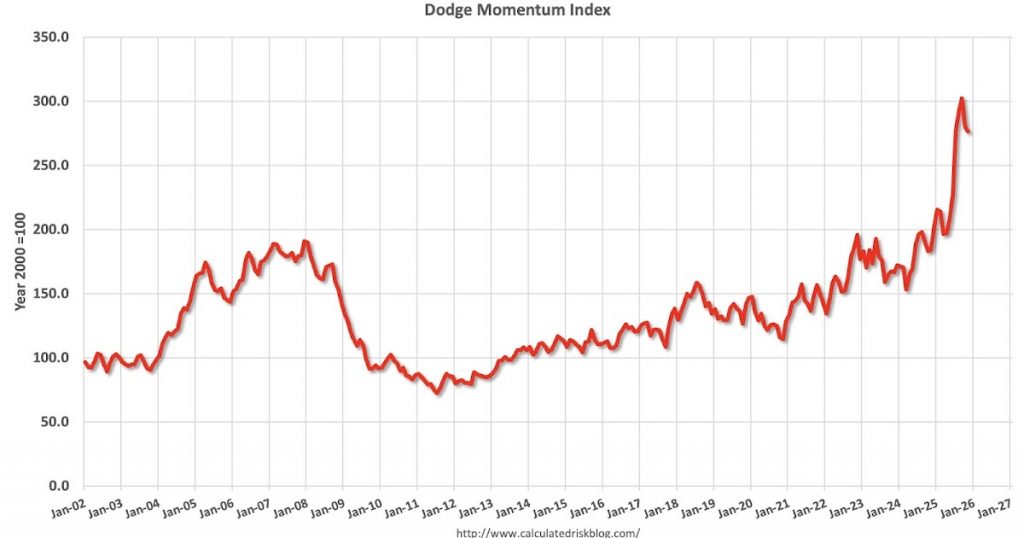

This graph shows the Dodge Momentum Index since 2002. The index was at 276.8 in November, down from 280.0 the previous month.

According to Dodge, this index leads “construction spending for nonresidential buildings a full year to 18 months”.

Commercial construction is typically a lagging economic indicator.