by Calculated Risk on 12/02/2025 08:26:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Final Look at Housing Markets in October and a Look Ahead to November Sales

A brief excerpt:

After the National Association of Realtors® (NAR) releases the monthly existing home sales report, I pick up additional local market data that is reported after the NAR. This is the final look at local markets in October.

There were several key stories for October:

• Sales NSA are essentially unchanged YoY through October, and sales last year were the lowest since 1995! And the YoY comparisons for November and December will be more difficult.

• Sales SAAR (seasonally adjusted annual rate) have bounced around 4 million for the last 3 years.

• Months-of-supply is above pre-pandemic levels.

• The median price is up 2.1% YoY, and with the increases in inventory, some regional areas will see further price declines – and we might see national price declines later this year (or in 2026).

Sales at 4.10 million on a Seasonally Adjusted Annual Rate (SAAR) basis were at the consensus estimate.

Sales averaged close to 5.38 million SAAR for the month of October in the 2017-2019 period. So, sales are about 24% below pre-pandemic levels.

…

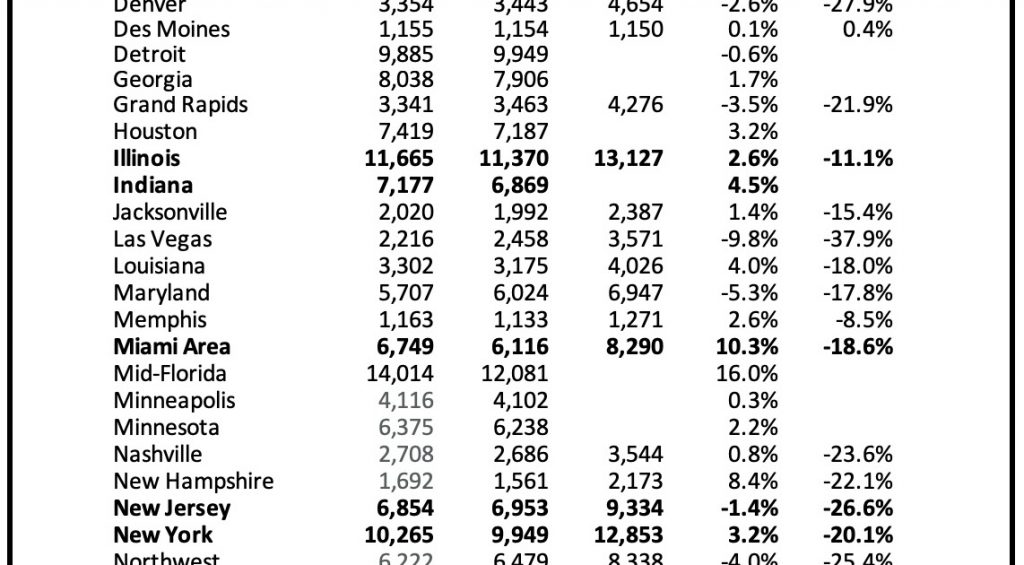

In October, sales in these markets were up 2.4% YoY. Last month, in September, these same markets were up 7.7% year-over-year Not Seasonally Adjusted (NSA). The NAR reported sales were up 2.9% YoY NSA, so this sample is close.

Important: There were the same number of working days in October 2025 (22) as in October 2024 (22). So, the year-over-year change in the headline SA data was similar to the change in NSA data (there are other seasonal factors).

…

More local data coming in December for activity in November!

There is much more in the article.