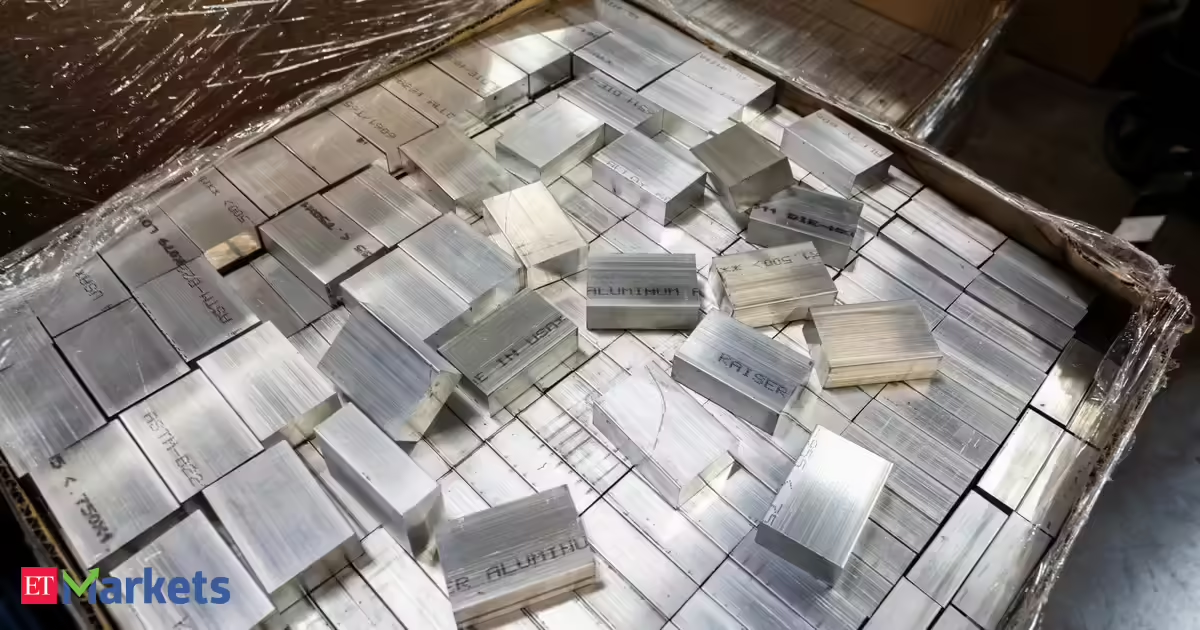

India’s aluminium futures on MCX surged to a record territory above ₹320/kg in early January 2026, mirroring a sharp upswing on the London Metal Exchange (LME), where prices broke $3,000/ton for the first time since 2022 amid tightening global supply. As a core industrial metal in India’s growth story, aluminium’s 2025–26 rally is rooted in constrained global supply, policy-driven trade frictions, and resilient end-use demand.

Why India rallied so hard

Several India-specific forces have amplified the global uptrend. First, a persistent domestic premium over LME reflects tight local supply, strong end-use demand especially in areas like power, construction, and automotive. In addition, relatively limited scrap availability is forcing greater reliance on costlier primary metal.

Second, periodic producer price revisions and robust order books have kept physical premiums elevated in India even when regional benchmarks softened, pointing to sticky local fundamentals. Finally, tight global inventories and LME prices pushed through milestone levels also aided the sentiment.

Global sentiment drivers

Globally, aluminium’s rally is anchored in supply constraints and energy costs. Europe’s smelters remain scarred by high electricity prices. Additionally, China’s capacity cap curbs – China cannot officially increase smelting capacity beyond 45 Mt, unless they remove or replace existing ones, tightening balances and supporting prices. LME warehouse data and market commentary point to low and rotating inventories and rising physical premiums, reinforcing tightness across consuming hubs.

Live Events

Global supply–demand: where are we now?

International Aluminium Institute (IAI) updates through 2025 show world primary output growing only marginally with total production tracking near 73–74 Mt, a slower pace than 2024. Fast markets and industry briefings highlighted surging premiums further tightening apparent availability for spot buyers. In short, supply growth is tepid while demand from transport, packaging, power, and construction remains resilient, conditions that typically support higher prices.

China: internal demand and production

China produces about 60% of the world’s aluminium and is crucial to global supply. Its production is near the government-imposed capacity limit, so growth is slow. Domestic demand is strong—especially from electric vehicles, appliances, and power grid projects—so exports have fallen. Power shortages in key smelting regions have caused temporary smelter cuts, adding to supply concerns. Because of these limits and high energy costs, China is now focusing more on recycled aluminium, which is becoming key for future growth since expanding primary production is restricted.

Have U.S. tariffs affected the commodity?

Yes, U.S. tariffs have had a big impact. In 2025, U.S. raised aluminium tariffs to 25% for all countries and 200% for Russia and extended them to more aluminium products. These changes made compliance harder and increased costs for importers. By early 2026, U.S. aluminium premiums hit record highs and inventories dropped because tariffs, combined with tight global supply, pushed prices up, showing that the policy has tightened the U.S. market and influenced global trade.

Industry impact

High aluminium prices are squeezing multiple industries. Automakers and EV manufacturers, which depend on aluminium for lightweight designs, face rising input costs that can cut margins. This may delay new models and push them toward alternative alloys or increased scrap usage. Construction and infrastructure projects are also feeling the pinch, as aluminium-based cladding, window frames, and transmission components become more expensive—forcing public tenders to be re-priced and private developers to reconsider timelines.

Packaging and power sectors are not immune either. Can-sheet and foil producers are passing on higher costs, while utilities using aluminium conductors instead of copper see budget pressures. In India, strong demand from cables, consumer goods, and fabrication keeps premiums high, but prolonged price strength could force smaller manufacturers to switch to cheaper substitutes or postpone upgrades. Overall, the surge in aluminium prices is rippling across industries, raising costs, and challenging growth plans.

Price outlook for 2026

With LME around $3,000+/t and MCX near ₹320/kg to start the year, baseline scenarios point to elevated but choppy prices in 2026. The bull case rests on China’s capacity cap plus intermittent hydropower risks, slower European smelter restarts amid high power costs, sticky U.S. tariffs, and continued demand from EVs, packaging and grids.

The bear case would require clearer surplus signals like stronger global restarts, softer macro, or rapid recycled supply growth. There are expectations of small deficits in 2025–26 to modest surpluses later, but most agree balances are tight and premiums elevated. For India, domestic premiums and policy frictions could keep MCX trading above global parity, especially if infrastructure demand and producer pricing remain firm.

(The author Hareesh V is Head of Commodity Research, Geojit Investments Limited. Views are own)

(Disclaimer: Recommendations, suggestions, views, and opinions given by experts are their own. These do not represent the views of the Economic Times)