More than 40% of Medicare Advantage members in seven states were forced to seek new coverage in 2025 after insurers withdrew from those markets, according to a recent Reuters report.

Vermont was hit hardest, with roughly 92% of its enrollees affected. The other states facing major disruptions were Idaho, Wyoming, North Dakota, South Dakota, Maryland, and New Hampshire.

Reuters noted that Medicare serves about 60 million older adults and people with disabilities. Roughly half participate in privately run Medicare Advantage plans, while the remainder receive benefits through the traditional federal program.

Related: Dave Ramsey bluntly warns Americans on 401(k)s

Insurers told Reuters that rising costs and lower government payments left many Medicare Advantage plans financially unsustainable for 2025, prompting companies to scale back or exit certain regions in 2026.

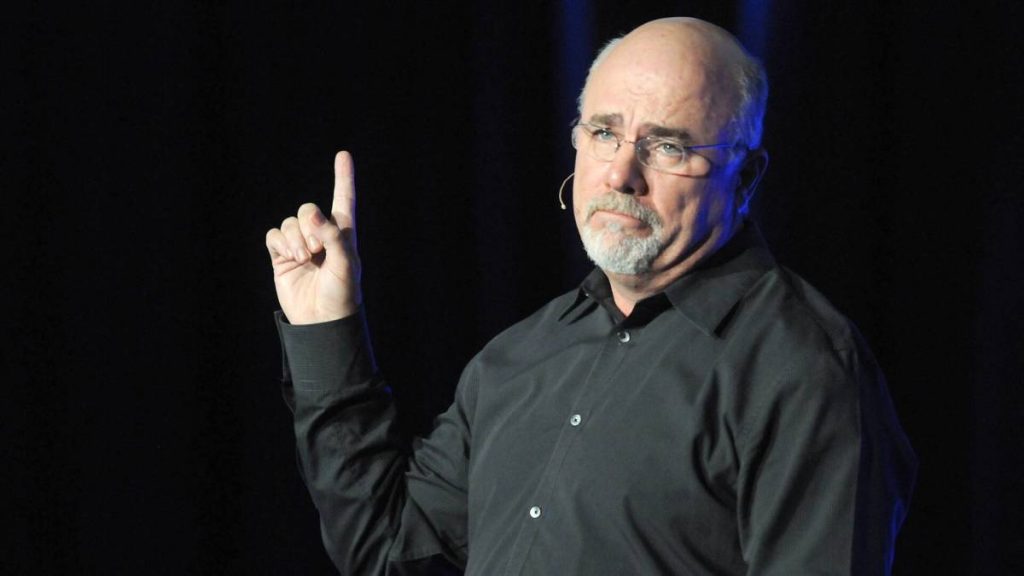

Bestselling personal finance author and radio host Dave Ramsey explains the confusing nature of Medicare policy that impacts millions of retired Americans.

“You’ve reached your golden years. You’ve got a lot of life under your belt and wisdom under your hat. Things should be easier now,” he wrote.

“So, why does this dang Medicare feel so confusing?” he asked, sounding an alarm as well as offering advice. “Well, it was created by the government so that might be your first clue. And second, it’s just a lot to understand.”

A doctor is seen speaking with a Medicare patient.

Shutterstock

Dave Ramsey focuses Americans on Medicare Advantage

Medicare has a number of different parts, which I’ll get to after making this point: It is known as Medicare Part C. But Ramsey helps us understand it in simple terms.

“With Medicare Advantage, you get all the parts bundled into one plan — and some plans even cover things like vision, hearing and dental services,” he wrote. “Medicare Advantage plans are offered through private insurance companies.”

“Most plans include drug coverage,” he continued. “There is also a yearly limit to how much you’ll pay out-of-pocket. How much you’ll pay out-of-pocket for services though is different with each service. It could be higher or lower than the Medicare-approved price.”

In my many years of reporting on retirement concerns, I have always admired Ramsey’s ability to get straight to the point in easy-to-understand terms, to help remove some of the confusion.

Ramsey clarifies Medicare Advantage’s strengths, weaknesses

Medicare Advantage works more like a standard private insurance plan when it comes to choosing doctors. A person is generally restricted to providers within the plan’s network, and in many cases they’ll need approval from a primary doctor before seeing a specialist.

If the insurer running a Medicare Advantage plan refuses that referral, one could be responsible for the full cost.

Even though Medicare Advantage plans consolidate coverage into a single card, the setup isn’t as simple as it sounds. A person still owes their regular Part B premium, and on top of that, they pay an additional premium for the Advantage plan itself.

More on personal finance:

- Zillow forecasts big mortgage change for U.S. housing market

- AARP sounds alarm on major Social Security problem

- Dave Ramsey bluntly warns Americans on 401(k)s

This is the point I believe Ramsey is trying to drive home:

“The big thing to note about Medicare Advantage plans is you have less control than you’d have with Original Medicare,” he wrote. “You have to go where the plan network says and you can’t get just any service (like a specialist) without a referral (and they can deny you).”

“Medicare Advantage is sometimes the right fit for some people,” he continued, with a warning.

“But watch out for insurance agents and Medicare advisors who push Medicare Advantage no matter what. They make more money from selling you Medicare Advantage — and it’s easier because it comes in one package so they don’t have to chase down a supplement policy that fits your needs.”

The Medicare parts

These are the Medicare parts, according to the Centers for Medicare and Medicaid Services:

Medicare Part A — Hospital insurance

- Covers inpatient hospital care

- Includes skilled nursing facility care

- Provides hospice services

- Covers certain home health care

Medicare Part B — Medical insurance

- Covers doctor visits and services from other health care providers

- Includes outpatient care

- Covers home health services

- Pays for durable medical equipment (wheelchairs, walkers, hospital beds, etc.)

- Includes many preventive services such as screenings, vaccines, and annual wellness visits

Medicare Part C — Medicare advantage

- Offered by Medicare‑approved private insurers as an alternative to Original Medicare

- Bundles Part A, Part B, and usually Part D into one plan

- Often limits you to doctors and hospitals within the plan’s network

- May require referrals to see specialists

- Out‑of‑pocket costs and premiums vary by plan

- May include extra benefits not offered by Original Medicare

Medicare Part D — Prescription drug coverage

- Helps pay for prescription medications, including many recommended vaccines

- Available as a standalone drug plan added to Original Medicare

- Also included in many Medicare Advantage plans

- Run by private insurers that must follow Medicare rules

Related: AARP, SSA warn retirees about new benefit reductions