With 30 years of Wall Street experience, Co-Editor-in-Chief Todd Campbell explains Goldman Sachs’ latest take on the jobs market and why everyone should be paying attention to unemployment rates.

It wasn’t too long ago that you, me, and everyone else on Wall Street and Main Street were watching inflation like a hawk, wondering whether the Fed’s monetary policy was doing enough to keep it in check.

Inflation still matters (a lot), but in my opinion, the focus has shifted to the jobs market, and with it, to the Bureau of Labor Statistics‘ monthly employment situation survey. It lays bare where the rubber meets the road for the U.S. economy, how many people are working and pocketing paychecks, and how much more or less income they are making than last year.

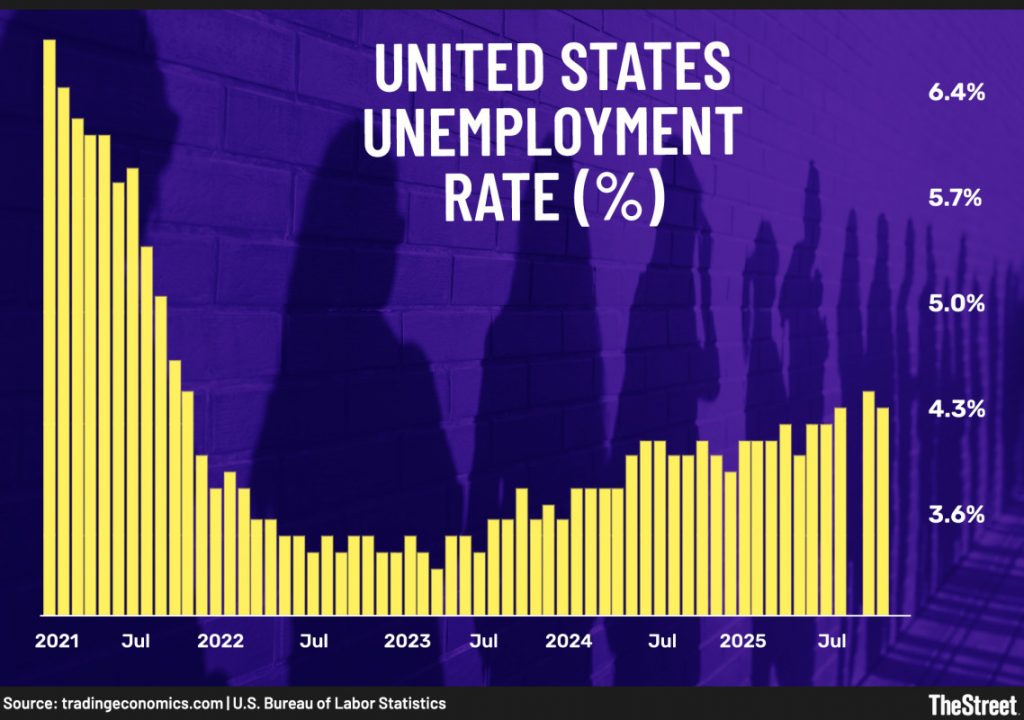

Over the past year, it’s told a concerning story, and investment bank powerhouse Goldman Sachs‘ new report suggests that the next release, scheduled for Feb 11, won’t change that.

The 157-year-old investment bank forecasts that January unemployment will remain unchanged from December at 4.4%, despite the Fed’s rate cuts in September, October, and December designed to spark hiring.

Goldman Sachs leaves open a chance that rounding may knock it down to 4.3% (it was 4.38% in December), but that would still reflect little progress and offer cold comfort to job hunters who have seen layoffs rising and job openings shrinking this past year.

Goldman Sachs lays out January unemployment forecast

Americans have been hamstrung by inflationary tariffs and rising layoffs, crimping budgets. Wages are growing, but inflation has increased to 2.7% from 2.3% last April, and unemployment has increased to 4.4% in December from 4% in January 2025.

Current Population Survey, Bereau of Labor Statistics and author's calculations.

Let’s look at the job market scorecard:

- Layoffs have risen substantially over the past year, with Challenger, Gray & Christmas reporting 1.2 million layoffs in 2025, ranking it the 7th worst year since 1989. January layoffs were the worst since recession-riddled 2009.

- Slowing wage growth and rising inflation have shrunk inflation-adjusted (real) income. Median wage growth slipped to 3.7% in December from 4.2% the year before, according to the Atlanta Fed’s Wage Growth Tracker. Real average weekly earnings growth has slowed to 1.07% from 1.75% in April, according to MacroMicro.

- And there are fewer open, unfilled jobs for unemployed workers to compete for, according to the Job Openings and Labor Turnover Survey, or JOLTS. In December, there were 6.5 million open jobs, down by 966,000 year over year.

Goldman Sachs thinks the January unemployment report will deliver much the same as December, with stable unemployment and a chance for a slight dip due to rounding.

“We estimate that the unemployment rate was unchanged at 4.4% in January,” said Goldman Sachs economists in a research report shared with TheStreet. “We see the risks as skewed to a decline: the bar for rounding down to 4.3% is not high from an unrounded 4.38% in December.”

Still, Goldman Sachs estimates the U.S. economy will come up short of Wall Street’s job forecasts, creating only 44,000 jobs versus consensus forecasts of 70,000.

The bank’s economists say to watch out for two things:

- The annual benchmark revision to the establishment survey: Expected to cause a negative 911,000 revision (consensus) to jobs created between April 2024 and March 2025. Goldman Sachs’ forecast is for a loss of 750,000 to 900,000.

- A methodological update to the birth-death model: Designed to reduce annual revisions, and starting this month, the birth-death model “will incorporate current sample information each month. This methodological change is intended to reduce the magnitude of annual revisions; however, it could contribute to greater month-to-month volatility in payrolls readings,” said Goldman Sachs.

The unemployment rate has major consequences

The employment report offers a snapshot into the jobs market, but the trend has major implications that go far beyond the data.

The economy is highly influenced by the rates banks charge borrowers, including households and businesses, and those rates generally move in the same direction as the Federal Reserve’s Fed Funds Rate, the rate at which banks lend overnight reserves to one another.

More Employment:

- Apple CEO Tim Cook drops strong immigration message

- Layoffs in January reach recession-era levels

- Amazon delivers Seattle purge ahead of earnings

What the Federal Open Market Committee (FOMC) does to the FFR has major consequences for how rich and poor consumers feel and how willing businesses are to invest in new stores, factories, and technology.

The Fed’s dual mandate seems simple:

- Low unemployment

- Low inflation

However, it’s anything but easy because those goals are often at odds with each other. Raising rates lowers inflation, like in 2023, but causes unemployment. Lowering rates has the opposite impact.

In 2025 and 2026, we’re still operating in the wake of the Fed’s significant war on inflation that began in 2022 and continued through most of 2024.

The Fed raised interest rates by 5.75% to knock inflation down from its 8% peak in 2022. It worked, but it also caused unemployment to surge to 4.4% in December from 3.4% in 2023.

Inflation has fallen, but the rise in joblessness has caused the Fed to pivot. It’s still nervous about inflation (Jerome Powell is losing his job in May because he was worried cutting rates last year amid tariffs was a mistake), but its priority pivoted in September to propping up the jobs market.

So far, it hasn’t worked, given unemployment remains near 12-month highs. In January, the Fed left rates unchanged rather than cutting them at a fourth consecutive meeting, giving the marketplace time to adjust and them more time to see the impacts.

My takeaway: If the BLS unemployment rate remains at 4.4%, as Goldman Sachs suspects, it adds pressure for a rate cut at the next FOMC meeting in March. If it retreats to 4.3% or lower, it’s good news for workers but bad news for borrowers, as the odds of another cut will likely shrink.

Related: Top bank revamps gold price target for rest of 2026