Americans, both those preparing for retirement and those already living it, can always gain from understanding a few essential facts about Social Security.

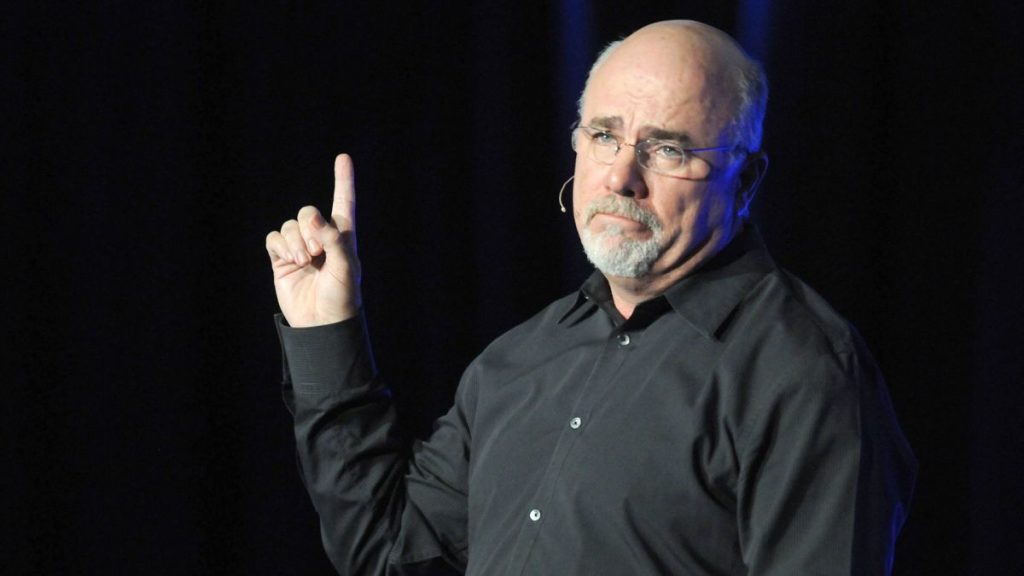

With that in mind, bestselling personal finance author and radio host Dave Ramsey offers his views on the federal program that provides financial benefits to retirees.

“Whether you’re just starting your career or you’re clocking out for the last time, it’s important to have a clear understanding of how Social Security works and how it fits into your retirement strategy,” Ramsey wrote.

Related: Dave Ramsey bluntly warns Americans on 401(k)s

Social Security was established in 1935 as a way to offer financial support to retired employees, people with disabilities, the families of deceased workers, and dependents of eligible recipients.

Roughly 70 million people collected Social Security benefits in 2025, according to the Social Security Administration (SSA).

But Ramsey has a word of warning for Americans who may be relying too heavily on Social Security benefits for retirement income.

Dave Ramsey warns Americans on Social Security shortcomings

Ramsey emphasizes that it’s worth remembering that Social Security was designed to supplement retirement income, not replace it entirely for Americans.

“It was always meant to supplement your retirement income — like how a side of french fries is meant to ‘supplement’ your cheeseburger,” Ramsey wrote.

In 2026, the average Social Security monthly payment is about $2,000, which is not nearly enough for most people to fully live their retirement dreams.

In fact, a yearly income of $24,000 barely exceeds the poverty line for a two-person household of $21,640, according to the U.S. Department of Health and Human Services.

That means working Americans are wise to use a portion of their income to contribute to employer-sponsored 401(k) plans and Individual Retirement Accounts (IRAs) for money they will need when they retire.

Dave Ramsey explains 401(k)s

A 401(k) is an employer-sponsored retirement savings account, and it’s the most widely used workplace retirement plan.

While a 401(k) can hold a variety of investments, most plans give you a limited menu of mutual funds to choose from.

There are two main types of 401(k) plans — traditional and Roth — and the primary distinction between them is how each one is taxed.

A traditional 401(k) is funded with pretax dollars, allowing your savings to grow on a tax‑deferred basis. You don’t pay taxes on the money when you contribute, but you will owe taxes on the amounts you withdraw once you’re retired.

A Roth 401(k) works differently. Your contributions are made with after‑tax dollars, so the money in the account grows tax‑free, and you won’t owe taxes on your withdrawals in retirement.

More on personal finance:

- Zillow forecasts big mortgage change for U.S. housing market

- AARP sounds alarm on major Social Security problem

- Dave Ramsey bluntly warns Americans on 401(k)s

However, only the money you personally contribute receives this tax‑free treatment. If your employer matches part of your contribution, their portion grows tax‑deferred, meaning you’ll pay taxes on the employer‑match funds when you take them out.

For 2026, the maximum amount you can contribute to a 401(k) is $24,500. If you’re 50 or older, you can take advantage of catch‑up contributions and put in up to $32,500, according to the Internal Revenue Service (IRS).

Workers between ages 60 and 63 qualify for an even larger catch‑up amount of $11,250, bringing their total possible contribution to $35,750.

“You get to choose how much money you want to contribute to the plan, either a percentage of your salary or a set dollar amount, and that money will be taken out of your paycheck automatically,” Ramsey wrote.

“And many employers will offer a company match — that’s when your company offers to match a percentage of your retirement contributions in your 401(k). Translation? Free money!”

Dave Ramsey clarifies traditional IRAs and Roth IRAs

- Roth IRAs and traditional IRAs are both retirement accounts that offer tax benefits, but the timing of those benefits is what sets them apart, Ramsey wrote. (Source:Ramsey Solutions)

- A Roth IRA uses money that has already been taxed, allowing your investments to grow tax‑free and letting you take withdrawals in retirement without taxes. (Source:Ramsey Solutions)

- A traditional IRA is funded with pre‑tax dollars, giving you an immediate tax deduction, but all withdrawals in retirement — both your contributions and any growth — are taxed as income. (Source:Ramsey Solutions)

- Because Roth IRAs provide tax‑free growth and tax‑free withdrawals later on, they are often the stronger option for long‑term retirement savings. If you qualify, opening one and contributing as much as you can each year can significantly boost your retirement outlook. (Source:Ramsey Solutions)

- The limit on annual contributions to an IRA is increased to $7,500 from $7,000. (Source: Internal Revenue Service)

- The IRA catch‑up contribution limit for individuals aged 50 and over was amended under the SECURE 2.0 Act of 2022 to include an annual cost‑of‑living adjustment that is increased to $1,100, up from $1,000 for 2025. (Source: Internal Revenue Service)

Shutterstock

Dave Ramsey cautions Americans on Social Security solvency

The main Social Security Trust Fund will be able to pay 100% of total scheduled benefits only until 2033, according to the Social Security Administration.

At that time, the fund’s reserves will become depleted and continuing program income will be sufficient to pay only 77% of total scheduled benefits.

That means that without legislative action, Social Security recipients will get 23% less money from their monthly paychecks than they would currently expect.

Right now, about 2.7 workers contribute to support each Social Security recipient. By 2035, that figure is expected to drop to 2.4 workers for every beneficiary, according to the SSA.

The shift is driven largely by the retirement of millions of baby boomers, which will put additional pressure on the program in its current form.

The population of Americans aged 65 and older is projected to grow from 61 million in 2023 to 77 million by 2035, adding to that strain.

“What’s the bottom line?” Ramsey asked. “In its current state, the Social Security system is a mess — and you shouldn’t count on an inept government to fix it.”

“If by some miracle Social Security is around when you retire, you’ll have some extra money to work with. But understand, it’s your job to take care of you and your family, not Uncle Sam’s.”

Related: Dave Ramsey, AARP sound alarm on Medicare