Mutual funds are shifting to value the gold exchange traded funds through MCX polled domestic spot prices rather than relying on London Bullion and Metal Association (LBMA) prices.

All the MFs are changing their benchmark prices to MCX spot from LBMA. Nippon MF, ICICI MF, Bandhan MF and Motilal Oswal MF have recently aligned their benchmarks to MCX spot prices.

Since the NAV of gold ETFs reflects MCX prices, it will be more accurate and will reflect real-time trading activities in the Indian markets, providing a better value to domestic investors and thereby, reducing currency risk.

Besides, investors will no longer need to monitor international gold prices or the USD-INR exchange rate. Additionally, domestic spot prices will reflect the prevailing supply and demand of gold in the Indian market, thereby providing a better estimate of gold market value in India.

As of December, gold ETF assets stood at ₹1.28 lakh crore with physical holdings of over 77 tonne.

Swapnil Aggarwal, Director, VSRK Capital said mutual funds can now value their gold ETFs using domestic MCX spot prices.

Domestic gold prices traded at premiums of up to $25 per ounce during festive demand and later shifted to discounts of nearly $30 by year-end, movements that global benchmarks do not capture. In that context, MCX-based pricing offers a more accurate reflection of the Indian investor’s gold exposure, he said.

Partha Sengupta, Joint Managing Director & CEO, Systematix Private Wealth said gold ETF valuation in India is undergoing an important structural shift as regulators and market participants seek closer alignment between pricing benchmarks and domestic market realities.

LBMA-linked valuation imports dollar-rupee volatility into gold returns, even though investors are seeking pure commodity exposure. With the rupee depreciating about 5.6 per cent in 2025, this currency effect materially influenced ETF performance while the MCX-based pricing eliminates this distortion, he added.

However, liquidity on MCX is also lower than LBMA, which may widen bid-ask spreads during periods of stress which are practical trade-offs rather than structural shortcomings, he said.

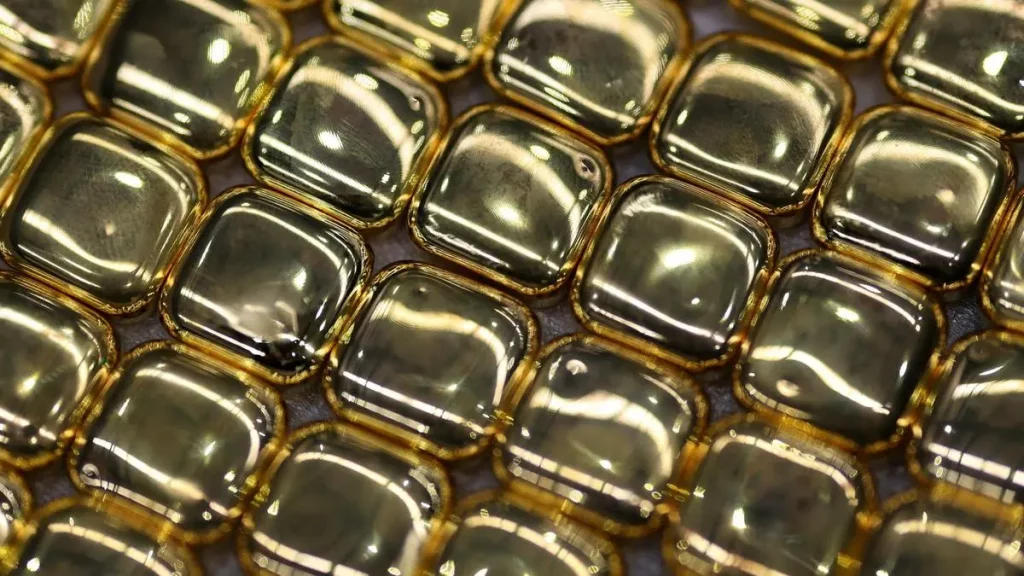

SEBI mandates all physical gold backing Indian ETFs be stored domestically with approved custodians, typically in the form of 99.5 per cent purity bars held in secure Indian vaults.

Published on January 12, 2026