Key Takeaways

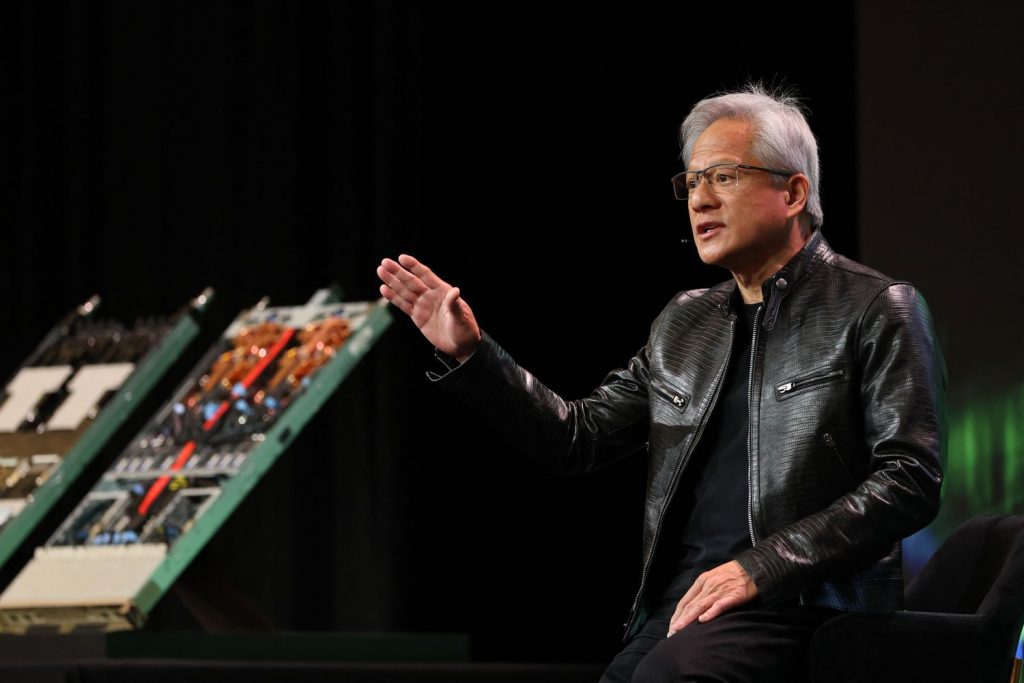

- Nvidia CEO Jensen Huang said the chipmaker is looking forward to selling its H200 AI chip in China after winning President Trump’s approval last month.

- The Chinese government’s latest moves to halt sales could endanger those plans, however.

Will Nvidia ever get to sell more of its AI chips in China? Investors see the country as a big opportunity—but getting there has been a challenge.

CEO Jensen Huang said this week that Nvidia (NVDA) is looking forward to selling its H200 AI chip in China after winning President Donald Trump’s approval in exchange for agreeing to give the U.S. government a 25% cut of sales. CFO Colette Kress yesterday said the U.S. government is “working feverishly” on the details, and the company expects to begin shipping to China soon.

But the Chinese government’s latest moves to halt sales could hobble those plans. Beijing has ordered companies to halt H200 orders, and could follow with a mandate that firms buy domestic chips instead, The Information reported Wednesday. An Nvidia spokesperson declined to comment on the report.

Why This Is Significant

While Nvidia and its investors may be eager to see multibillion-dollar revenues in China grow thanks to new U.S. export licenses, the chip company still faces political hurdles before it realizes those sales.

More access to China’s market, which Huang has said could be a $50 billion annual opportunity for Nvidia, would represent a significant source of growth for the company. (Nvidia is expected to report full-year revenue above $210 billion.) The chipmaker’s latest forecasts did not take China sales of the H200, or H20 that Trump greenlighted back in August, into consideration.

The H20, a less-powerful chip designed specifically for China’s market, has also met challenges from Beijing after receiving Trump’s backing. The approvals also face opposition at home, with bipartisan efforts by U.S. lawmakers in recent weeks to block the sales.

In a note to clients yesterday, analysts at Morgan Stanley nodded to possible sales of the AI chips in China as a source of potential upside for the company, but excluded them from their base case for the stock amid lingering political uncertainty. Analysts at Jefferies and Bernstein, who like Morgan Stanley hold “buy” or equivalent ratings on the stock, have also voiced some skepticism about the likelihood of sales.

Shares of Nvidia rose about 1% Wednesday, leaving them little changed for 2026 after climbing close to 40% last year.