Key Takeaways

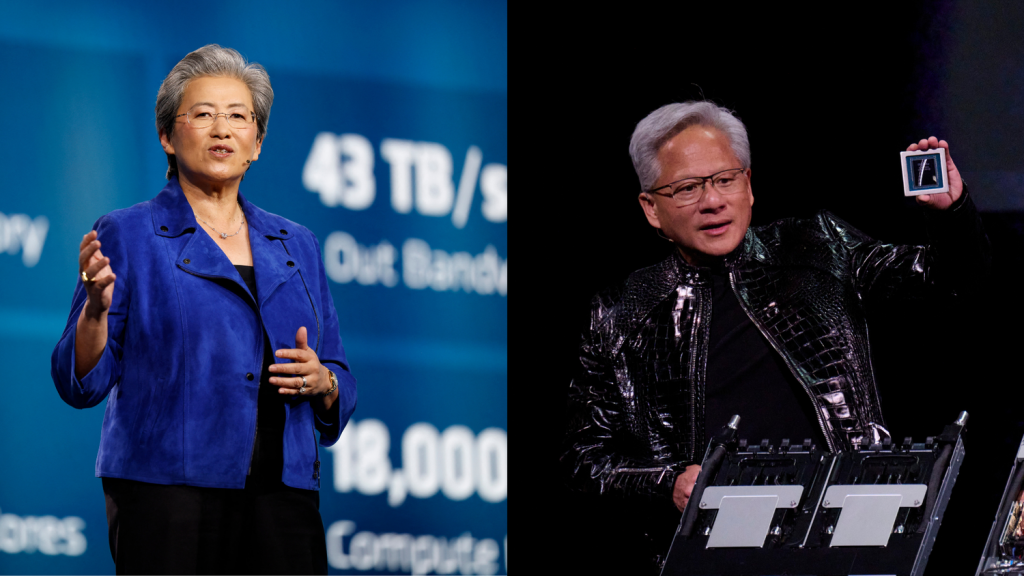

- AMD CEO Lisa Su told CNBC in an interview Tuesday that she believes physical AI enabling autonomous machines such as humanoid robots and self-driving cars could be the “next big thing.”

- Nvidia CEO Jensen Huang earlier this week suggested a pivotal moment in robotics with AI may have already arrived.

The AI boom is only getting started, according to the industry’s biggest players, with some predicting that the next wave of innovations will come in the physical world.

So-called physical AI, which powers autonomous machines like humanoid robots and self-driving cars, could be the “next big thing,” Advanced Micro Devices (AMD) CEO Lisa Su told CNBC in an interview Tuesday. The company, Su said, is making physical AI a key part of its strategy.

Nvidia (NVDA) CEO Jensen Huang, who’s told investors he expects AI-driven robotics to transform industries and Nvidia to be a leading beneficiary of that shift, said Monday that he believes a pivotal “ChatGPT moment” for robotics may have arrived, with the company’s release of several new AI models for developers meant to unlock applications in the physical world.

Why This Is Important for Investors

Nvidia and AMD are both looking to physical AI as a source of growth that could expand sales to existing customers and win over new ones as more companies and industries adopt AI.

“Robotaxis are among the first to benefit,” Huang said, with Nvidia’s AI-powered driver assistance software set to be used in a new Mercedes-Benz car to enter production this year.

Analysts at Wedbush and Bernstein applauded Huang’s autonomous vision, with Bernstein telling clients physical AI could be “set for an inflection with Autonomous Driving leading the charge.”

Su’s comments come after AMD unveiled its newest AI products for data centers and PCs, as well as physical AI at CES in Las Vegas on Monday. Rival and industry leader Nvidia also showed off its latest chips at the conference.

Analysts surveyed by Visible Alpha are overwhelmingly upbeat about Nvidia’s stock, which on Tuesday reversed early gains to finish less than 1% lower despite broader market gains. They’re also largely bullish on shares of AMD, which slipped about 3% Tuesday.